18 Free Cover Letter Templates That Will Actually Get You Interviews

Optimize your cover letter18 Free Cover Letter Templates That Will Actually Get You Interviews

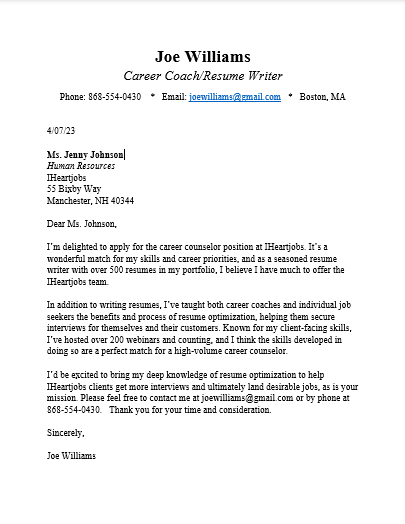

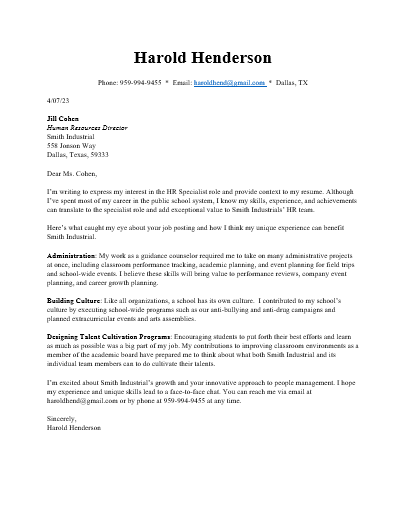

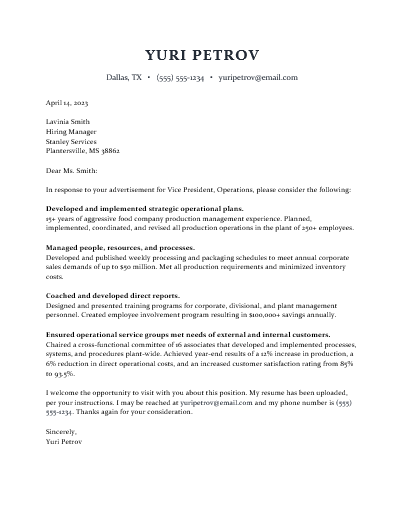

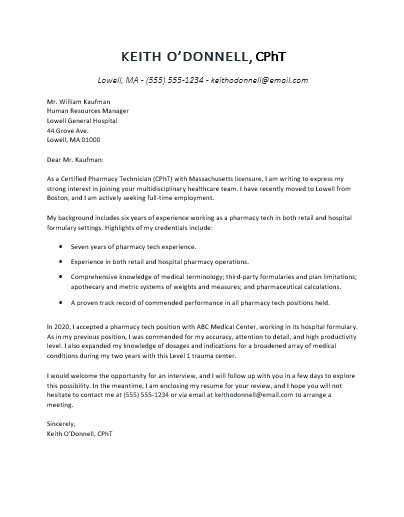

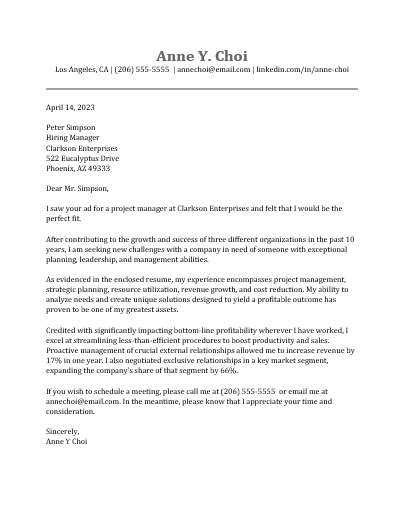

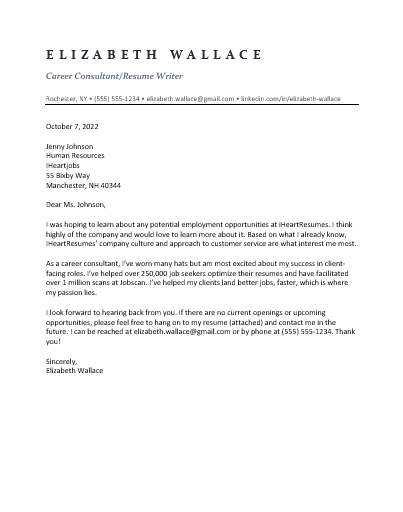

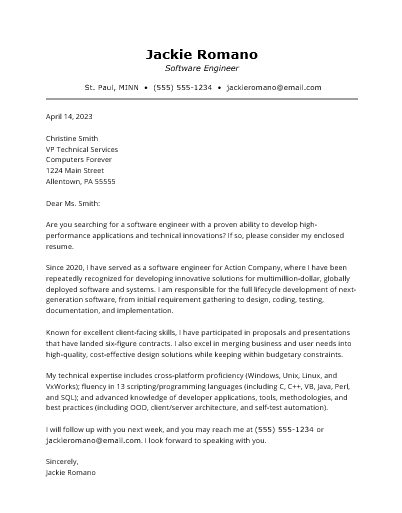

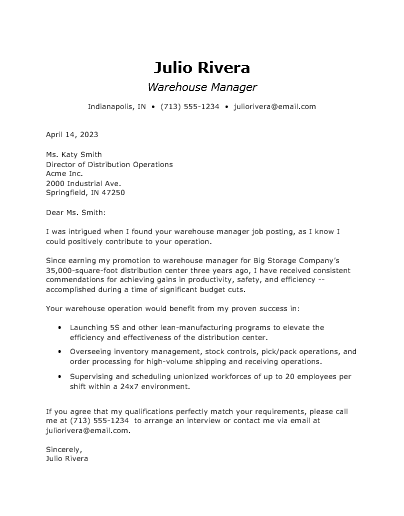

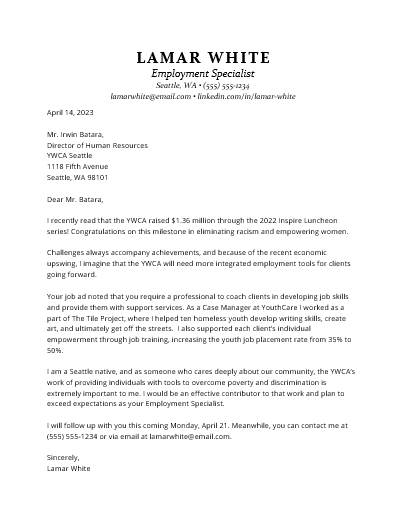

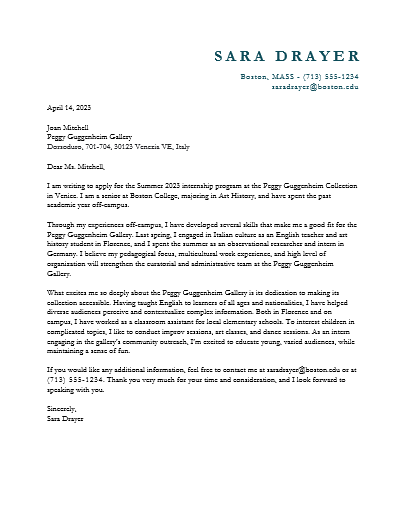

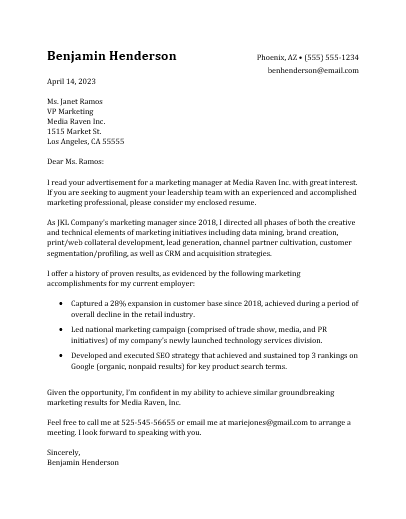

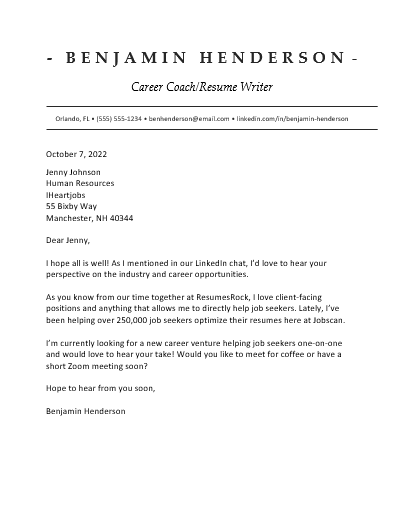

Jobscan’s cover letter templates are clean and professional. We intentionally avoided using flashy colors and design elements when creating them. Why?

Because most companies nowadays use applicant tracking systems (ATS) to screen resumes and cover letters. These systems can struggle to read and interpret visually complex documents.

This means your beautifully designed, eye-catching cover letter might remain stuck in an ATS database, never to be seen by an actual human being.

By using one of our simple, easy-to-read templates, you’ll significantly improve the chances that your cover letter will successfully pass through an ATS and into the hands of a hiring manager.

It’s super easy to get started too! Simply click the download button to get your hands on a Word document that you can customize to fit your unique situation.

When you’re done writing your cover letter, run it through Jobscan’s ATS-friendly cover letter checker to get personalized feedback on how to improve your letter and make it even more compelling to employers.

What is a cover letter?

It’s a letter of introduction that you send along with your resume when you apply for a job.

The key thing to remember about your cover letter is that it shouldn’t simply regurgitate your resume. Instead, it should support it.

Your cover letter can do this by:

- Explaining why you’re excited about the job opportunity.

- Showing how your skills and experience match the job requirements.

- Addressing any gaps in your work history.

- Showing off your personality (but not too much!).

By highlighting your strengths and showing your passion for the role and the company, your cover letter can make a strong case for why you deserve an interview.

Are cover letters necessary in 2023?

While some companies may not require one, a cover letter can still set you apart from other applicants and increase your chances of landing an interview.

In one survey, 83 percent of hiring managers said cover letters played an important role in their hiring decision.

In fact, most of the respondents in that survey claimed that a great cover letter might get you an interview even if your resume isn’t strong enough.

So don’t skip the cover letter! When done correctly, it can be a powerful tool in your job search toolkit.

Why should you use a cover letter template?

Here are the 5 main reasons why you should use a cover letter template.

- It saves you time by creating personalized letters quickly and easily.

- It provides a framework or structure for your cover letter.

- It ensures that all the necessary information is included.

- It makes it easy to customize your cover letters for multiple applications.

- It helps you create a professional and polished cover letter without starting from scratch.

A template helps you streamline the cover letter writing process. This means you can devote more time and energy to other important aspects of your job search, such as networking and researching potential employers.

What should you include in your cover letter?

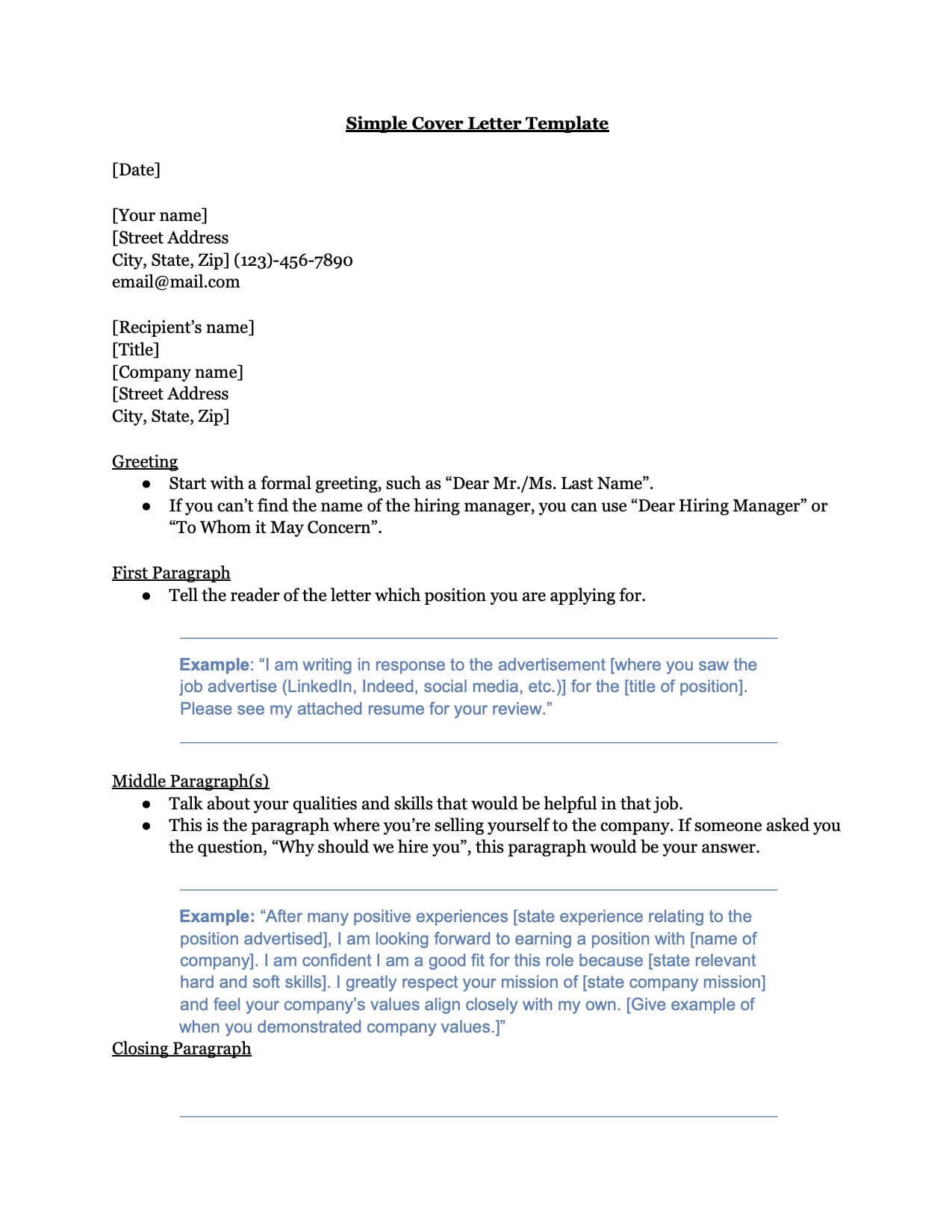

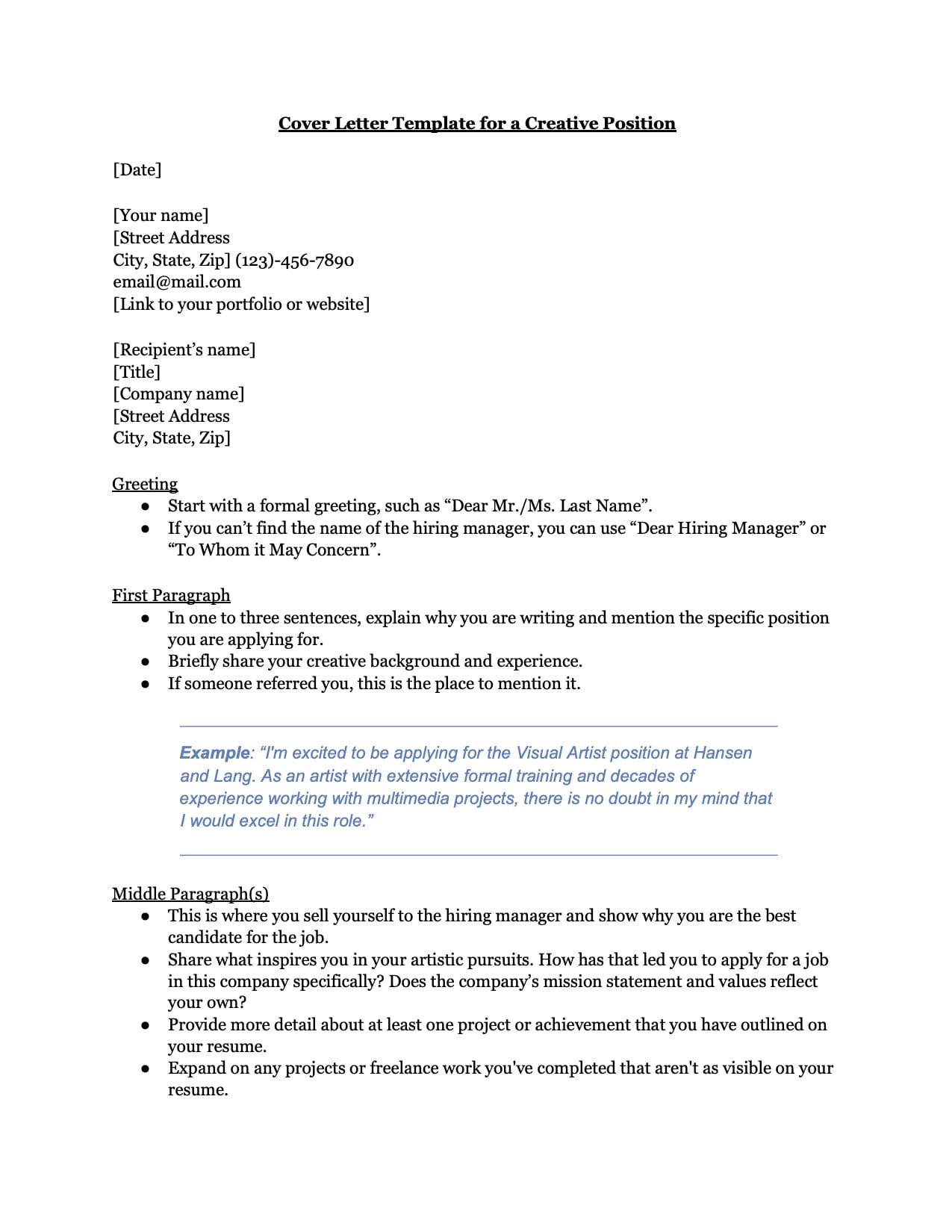

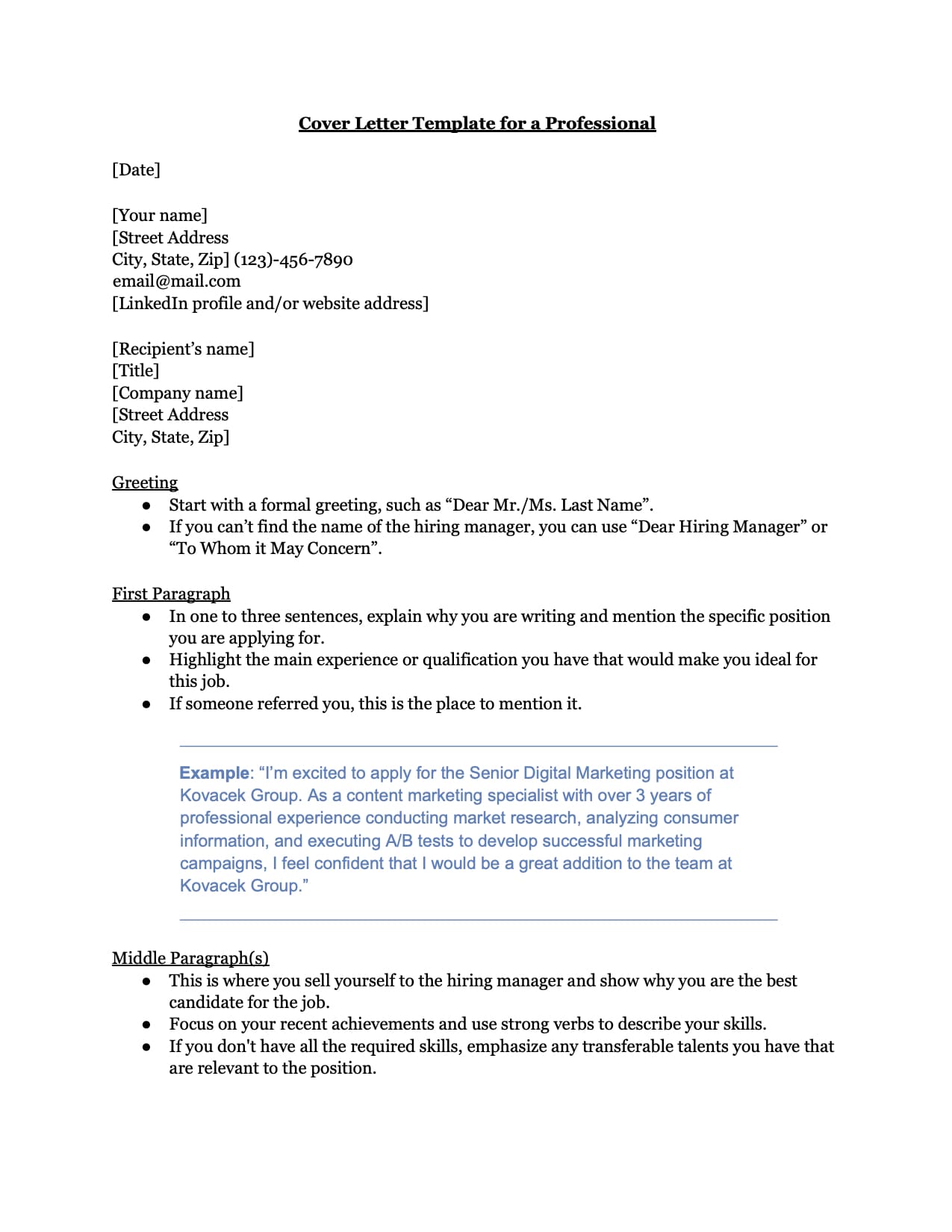

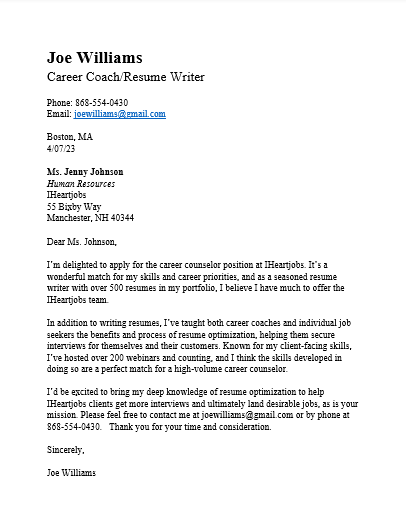

Every cover letter format should include the following information:

Contact information: Your name, address, phone number, and email address should be at the top of the letter.

Greetings: Address the letter to the hiring manager or the person who will be reviewing your application.

Opening paragraph: State the position you’re applying for and explain how you found out about the job. You can also briefly mention why you’re interested in the position and the company.

Body paragraphs: Use one or two paragraphs to highlight your relevant skills, experience, and qualifications that match the job requirements. Provide specific examples of your accomplishments and how they show off your abilities.

Closing paragraph: Repeat your interest in the position and thank the hiring manager for considering your application. You can also include a sentence or two about why you believe you’d be a good fit for the company culture.

Closing: Conclude your cover letter with a professional sign-off, such as “Best regards,” or “Sincerely”.

Do you need a unique cover letter for every job?

Absolutely! Do NOT use the exact same cover letter and simply change the name of the company and the position.

Instead, tailor each cover letter to the position you’re applying for.

You can do this by highlighting how your skills and experience match the specific requirements and responsibilities of the position.

It’s crucial to include the keywords that are in the job posting.

Why? Because your application will most likely go straight into an ATS database. Hiring managers search through this database for suitable job candidates by typing keywords into the search bar.

If your cover letter includes these keywords, it will be seen by the hiring manager. If it doesn’t include these keywords, your cover letter will remain in the database.

Not sure if your cover letter is ATS-friendly? Try running it through Jobscan’s cover letter checker.

This easy-to-use tool analyzes your cover letter and compares it to the job listing. It then identifies the key skills and qualifications that you should focus on in your letter.

How to write a cover letter if you have no work experience

If you don’t have much work experience, writing a strong cover letter can be challenging. But you can still do it!

Here are some tips to help you out:

Hook the reader right away. Introduce yourself and explain why you are interested in the position. If possible, mention a specific aspect of the company or role that especially appeals to you.

Highlight your relevant skills and experience. Focus on the skills you’ve gained through school projects, internships, volunteer work, or extracurricular activities. Be sure to provide specific examples.

Showcase your enthusiasm and willingness to learn. Employers look for candidates who are eager to learn and grow. Use your cover letter to convey your enthusiasm for the role and your willingness to take on new challenges.

Close with a strong call to action. End your cover letter by requesting an interview or expressing your interest in discussing the position further.

Proofread your cover letter carefully and customize it for each position you apply for.

Cover letter do’s and don’ts

- Use a generic greeting, such as “To Whom It May Concern.”

- Use a one-size-fits-all cover letter for all your job applications.

- Simply repeat your resume in your cover letter.

- Use overly casual or informal language.

- Write a long and rambling cover letter.

- Use jargon or technical terms that the hiring manager may not understand.

- Include irrelevant information or details.

- Send a cover letter with spelling or grammatical errors.

- Address the letter to a specific person or hiring manager, if possible.

- Include your contact information at the top of the document.

- Tailor your letter to the company and position you’re applying for.

- Use keywords from the job description.

- Highlight your relevant skills and experiences.

- Use specific, measurable results to demonstrate your abilities.

- Try to inject some of your personality into the cover letter.

- Proofread your letter carefully for errors.

- Run your cover letter through Jobscan’s cover letter checker.

FAQs

Q: How long should a cover letter be?

Most cover letters are too long. The ideal length is around 250-400 words. Hiring managers probably won’t read anything longer.

Q: Should I use a PDF or a Word cover letter template?

Either one should be fine. Some older ATS might not accept PDFs, but this is rare these days. Always check the job listing. If it says to submit a Word resume, then do that. Otherwise, a PDF resume works just as well.

Q: Can I email my cover letter instead of sending a cover letter?

Yes, you can email your cover letter instead of sending a physical copy through the mail. In fact, many employers now prefer to receive cover letters and resumes via email or through an online application system.

Explore more cover letter resources